- Southland property market remains stable, contrasting national volatility and declining asking prices.

- May 2024 sees Southland’s average asking price at $534,678 with minimal month-on-month change.

- Decrease in new listings and increased housing stock suggest a competitive market.

Stability Amidst National Trends

The latest property market data for Southland, including Invercargill, reveals a consistent and stable environment, contrasting with more volatile trends seen in other regions across New Zealand. The national average asking price dipped slightly by 1.6% year-on-year to $859,301, reflecting overall economic headwinds, yet Southland continues to demonstrate resilience.

Average Asking Prices in Southland

In Southland, the average asking price for May 2024 stands at $534,678, showing a minimal month-on-month change of 0.1%. This stability is significant when compared to the national trends and highlights the region’s robustness. Southland’s property market has managed to maintain equilibrium despite broader economic pressures, such as high inflation and restrictive interest rates.

New Listings and Housing Stock

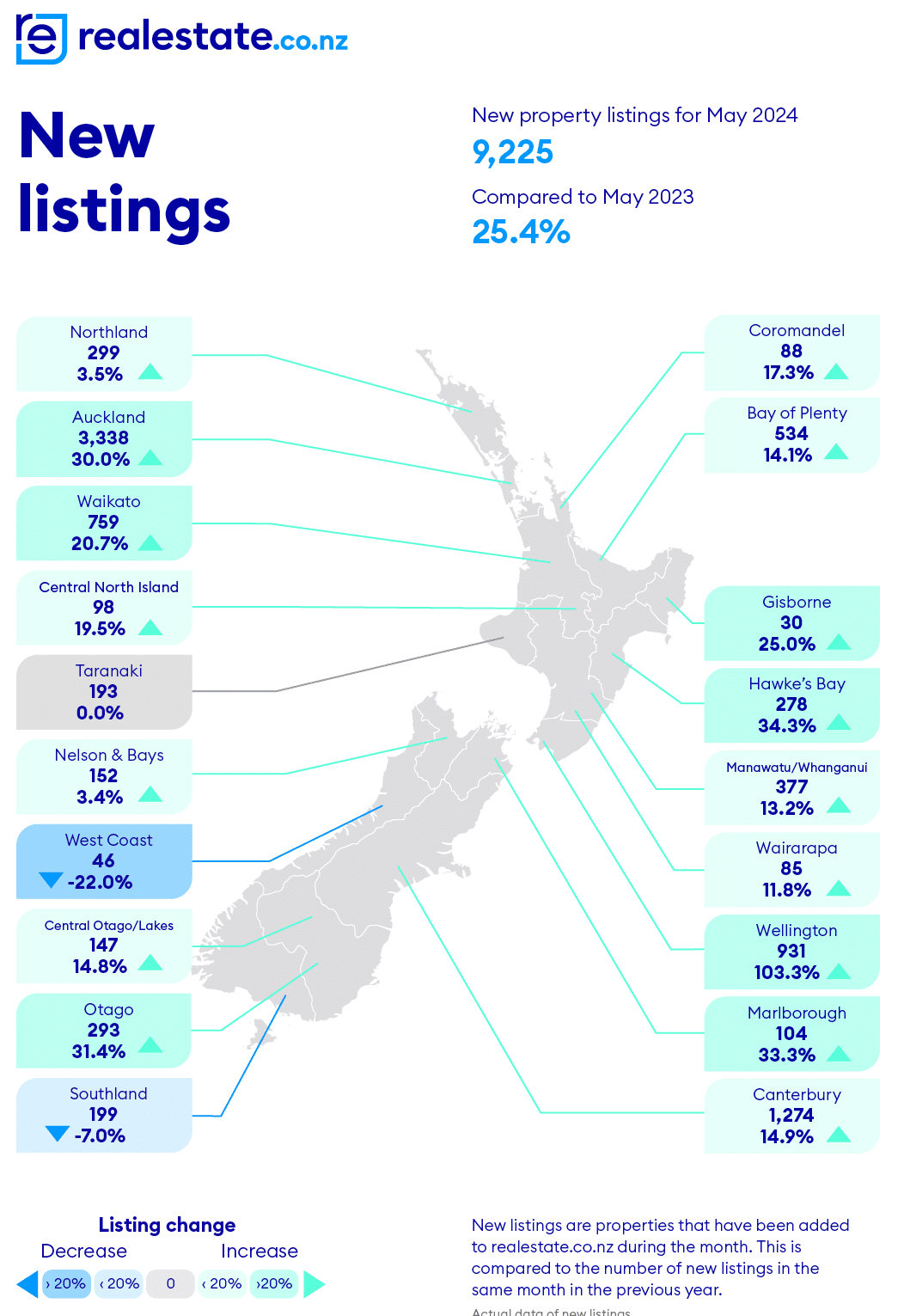

New property listings in Southland for May 2024 total 199, marking a decrease of 7.0% compared to the previous year. This decline in new listings suggests a tightening supply, which could potentially bolster asking prices in the near term as demand pressures increase.

The total housing stock in Southland is recorded at 536 units, up by 5.2% from the same period last year. The increase in housing stock provides prospective buyers with more options and might contribute to a more competitive market landscape for sellers

Market Sentiment and Inventory Levels

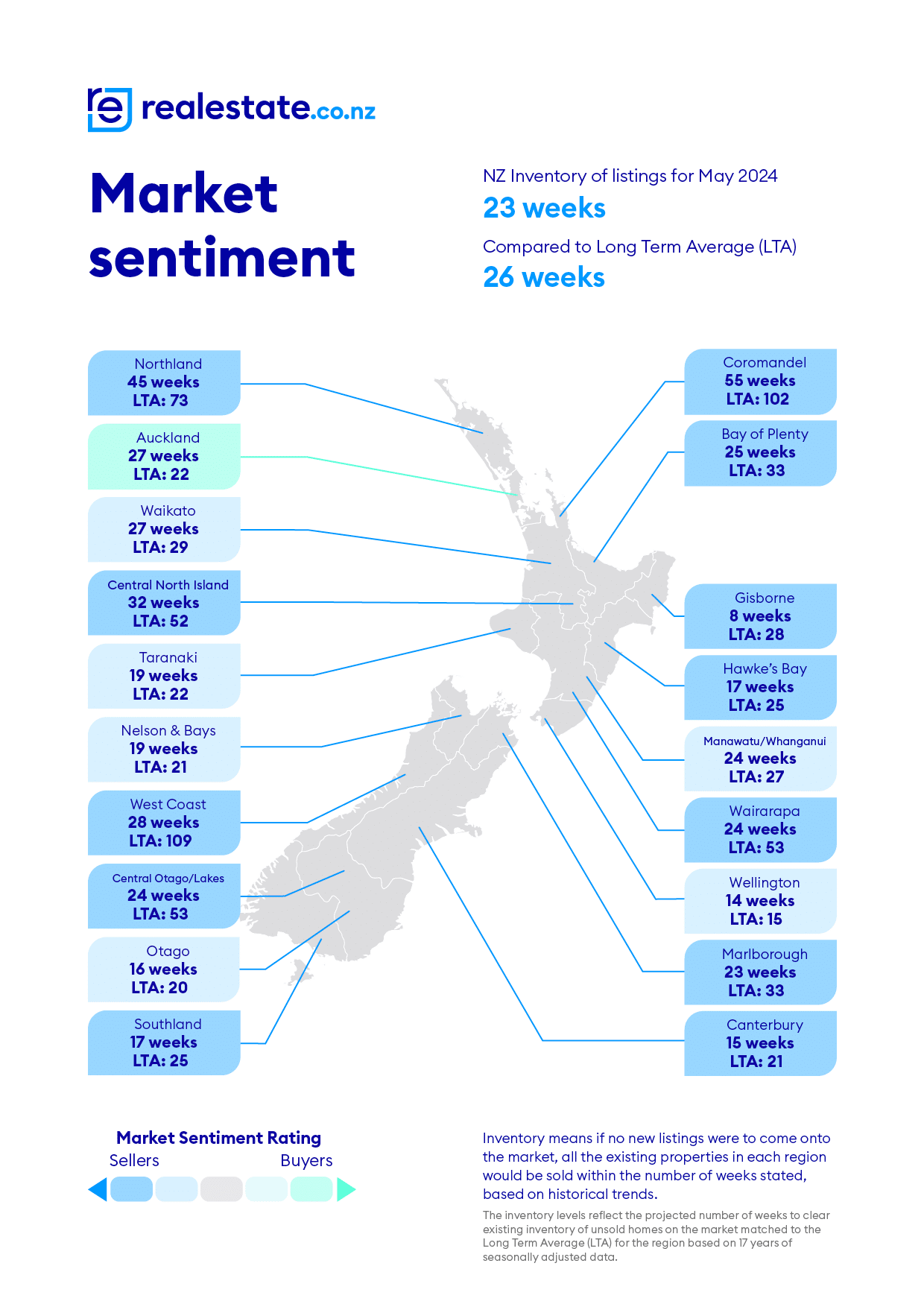

Southland’s inventory level for May 2024 is reported at 17 weeks, compared to a long-term average (LTA) of 25 weeks. This indicates a faster turnover rate, suggesting that properties are selling quicker than usual. The reduced inventory duration aligns with increased buyer activity and a sustained interest in the region’s property market.

Conclusion

Despite national economic challenges, Southland, and particularly Invercargill, has shown remarkable stability in its property market. The region’s consistent asking prices, manageable inventory levels, and slight increase in housing stock illustrate a balanced market, making it an attractive area for both buyers and sellers.

As always, consulting with local real estate experts is advisable to navigate this stable yet dynamic market environment effectively.