A major South Island commercial property owner believes the Invercargill City Council isn’t being truthful about the proposed City Block funding.

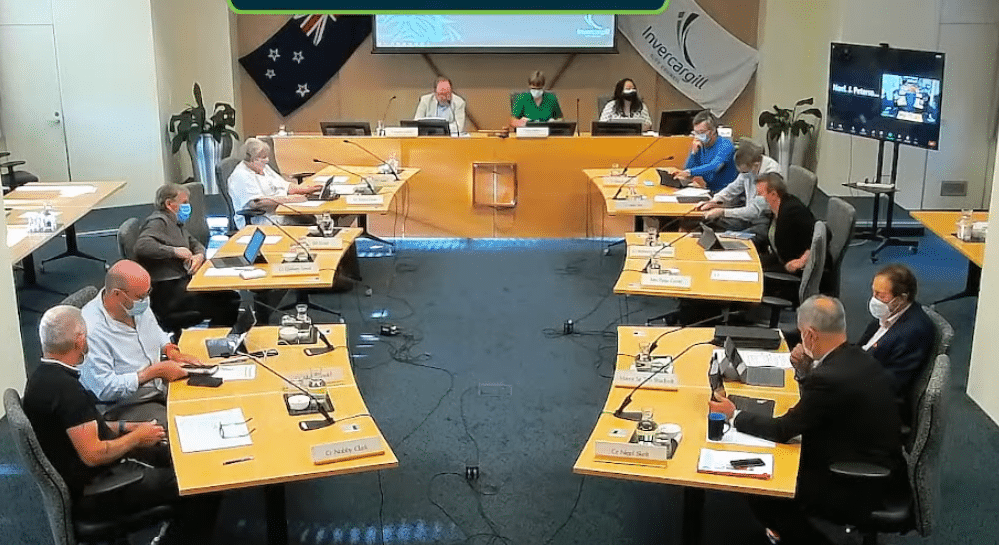

Thompson Property Group Ltd founder Gaire Thompson spoke to the Performance, Partnerships and Policy meeting today, as a submitter against the increased investment into the major CBD upgrade.

Based in Nelson, Thompson owns the Dee Street building where Farmers is currently, and also bought the Invercargill Railway Station in September last year – as well as selling the Menzies Building to Geoff Thomson for a 4.5 star hotel.

In 2020 Gaire also tried to put a halt to demolition work on the inner-city development, filing a High Court injunction – saying it was because of concerns from ratepayers about some of the funding.

The community was recently consulted about the extra investment needed by ICC for the City Block development, after Invercargill Central Ltd admitted its $45 million commercial bank loan had been affected by changes to its rent profile.

It had been proposed that the council and HWR Richardson Group both put up a short-term loan of $22.75m each to cover that commercial bank loan shortfall.

A total of 79 submissions were received for the extra funding proposal with 74.7% in support, with many people saying they just wanted the project to be done and properly.

But Gaire told the meeting today he had ongoing concerns about the project and felt that the ratepayers would be left to “carry the can.”

He doesn’t believe the council should have got involved in the development at all, as a 45.8% shareholder, and should have been left for the private sector.

“I am not at all surprised at the latest consultation for extra funds for this very expensive project, but am disappointed that the council are not being truthful in their request for ratepayer support.

“Firstly they made the mistake of allowing the resource consent for the development to proceed to be changed from, one where the developers had their finance arranged, to one where they were comfortable that they would get their finance. Now to say that the bank finance is not available because of a change of economic environment and increased costs is not correct, particularly when we are being told that it is within budget.

“The truth is that they were never going to meet the banks terms to get the funding to complete the development because of insufficient net rental.

“To also say that leaving the short term finance in will not cost the ratepayer is not true , as now being the largest shareholder at 45.8% there will be a long period before they get a return.”

Council responded in a submitter’s report, saying the information was factually correct, the loan will be made at commercial rates higher than the cost of borrowing to council, and as a result there will be no rates impact.

Following hearings, the Performance, Policy and Partnerships Committee will deliberate on their decision on investment for City Block and City Streets Stage Two on the morning of February 22.

The final decision will be made by Council the same day, and that decision will be taken into account for the Annual Plan budgeting process.