- Average income households to receive tax cuts up to $102 per fortnight.

- FamilyBoost childcare payments offer eligible families up to $150 per fortnight.

- Tax cuts funded through savings and revenue initiatives, no additional borrowing needed.

The government has announced a tax cut for average income households, providing up to $102 per fortnight from the end of July. This move aligns with National’s election promises. The tax cuts are part of a larger plan, unveiled in Budget 2024, that includes reinstating interest deductibility for landlords. The plan averages $3.7 billion per year and will be funded through savings and revenue initiatives. These include $1.2 billion in public service cuts, cancelling some of Labour’s initiatives, and shifting the tertiary education ‘fees free’ programme to the final year of study.

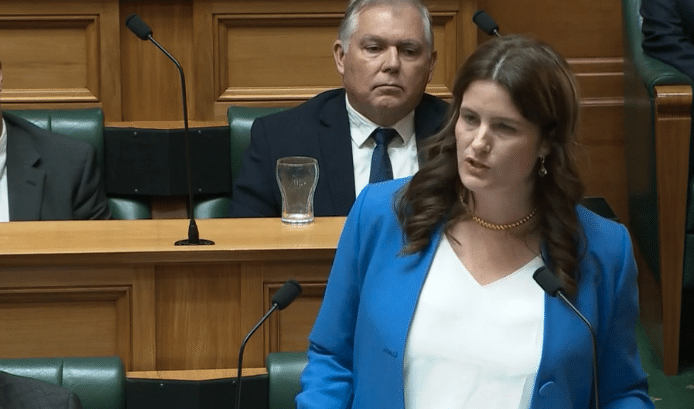

Finance Minister Nicola Willis assured that these tax cuts would not require additional borrowing, thus avoiding inflation. A tax calculator is available on the budget website for individuals to see how the changes will affect them.

The tax package will benefit 3.5 million New Zealanders, or 83% of the population, according to the Budget documents. Eligible families will also receive a FamilyBoost childcare payment of up to $150 per fortnight. On average, households with children will receive $78 per fortnight, while working-age New Zealanders will get $32 per fortnight.

Minister Willis highlighted that these are the first tax cuts in 14 years, addressing the prolonged cost of living crisis and providing much-needed relief to hardworking Kiwis. The government aims to provide a fairer deal to low and middle-income households, particularly families with young children.

Income tax thresholds will be raised to compensate for wage growth, and eligibility for the independent earner tax credit will be expanded. FamilyBoost and the in-work tax credit for low and middle-income families will also see increases.

A single person earning $55,000 a year will be better off by about $51 per fortnight. These changes strongly favour low-to-middle-income working families with children.

The tax plan aligns with the National Party’s proposals, with adjustments for coalition agreements. As part of the National-NZ First agreement, the foreign buyers’ tax will not proceed. Instead, funding for IRD tax audits and oversight work will be increased, generating extra revenue and ensuring fairness in the tax system. Replacing the first year ‘Fees Free’ programme with a final year ‘Fees Free’ programme has also contributed to the savings.

Although flattening the tax scale was considered, it was not implemented as it did not provide the same benefits as the current plan. However, this idea remains a possibility for the future.

Budget 2024 also includes significant funding boosts: over $16 billion for health over four years, $2.9 billion for education over four years, $1.1 billion for disabled people over five years, $651 million for police over four years, and $1.2 billion over three years for a Regional Infrastructure Fund. Additionally, the kapa haka festival Te Matatini will receive long-term funding of $48.7 million from 2025.

Universal free prescriptions, a key feature of the previous Labour Government’s budget, will be scrapped. They will now only be available to under-14s, community service card holders, and those over 65.