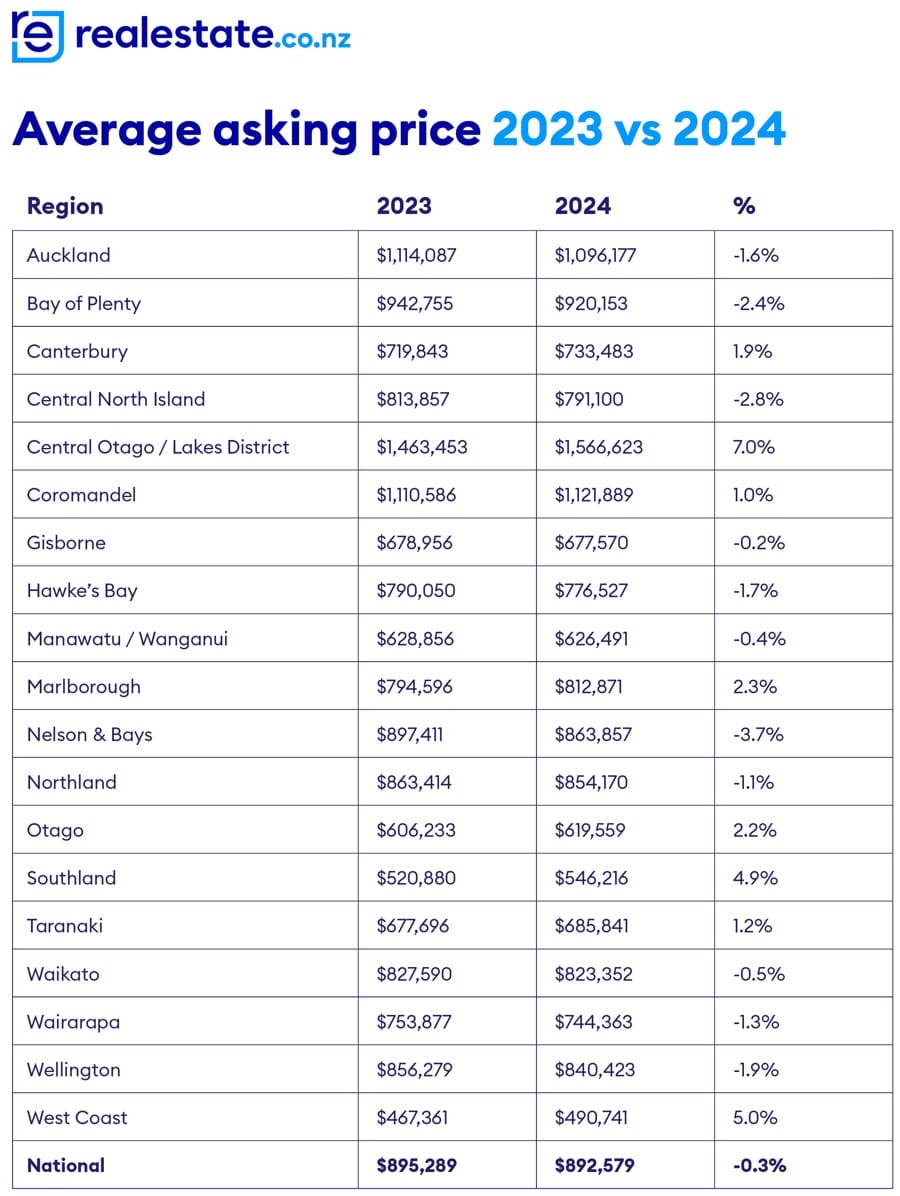

The New Zealand property market experienced a significant surge in 2024, with over $115 billion worth of residential property listed, marking a $19 billion increase compared to 2023, according to realestate.co.nz. Among the notable trends, Southland stood out with an impressive 4.9% growth in average asking prices, rising from $520,880 in 2023 to $546,216 in 2024.

The region also saw a 9.4% increase in new property listings, totaling 2,246 homes.

Related: Southland Property Market Defies National Downturn

Vanessa Williams, spokesperson for realestate.co.nz, described 2024 as a "perfect market," where a balance between stable asking prices and increased supply offered buyers and sellers an ideal environment for making confident decisions. Nationally, average asking prices dipped slightly by 0.3%, demonstrating a rare consistency across the market.

South Island Highlights

Southland wasn’t alone in its growth. Central Otago/Lakes District led the country with a 7.0% rise in average asking prices, reaffirming its position as New Zealand's most expensive region. The West Coast followed closely behind Southland, recording a 5.0% increase, showcasing strong demand across varying price points in the South Island.

"From premium properties in Central Otago to more affordable options in Southland and the West Coast, the South Island continues to attract buyers looking for lifestyle opportunities outside major centres," said Williams.

Listing Surge Offers Opportunities

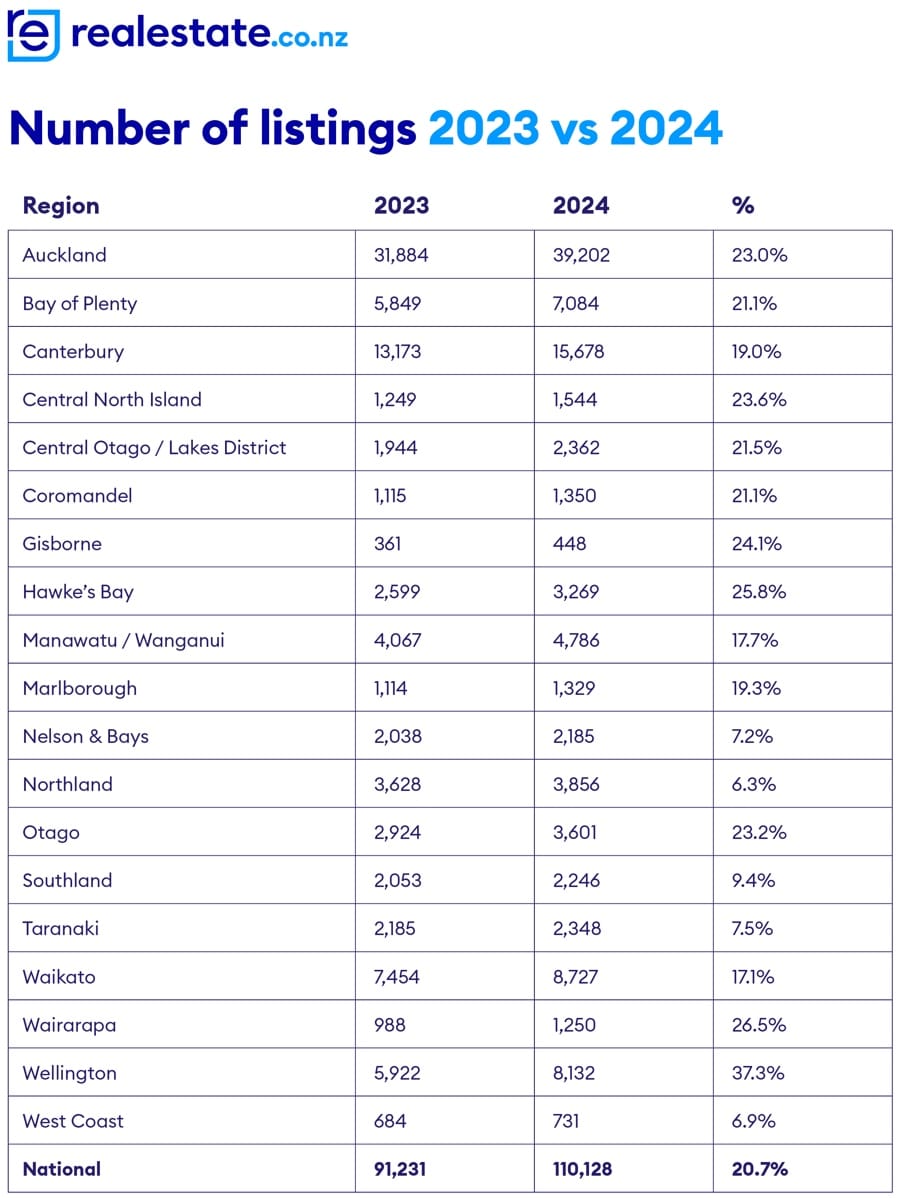

Invercargill and Southland are part of a nationwide trend of increased property listings, with New Zealand seeing over 110,000 new residential properties enter the market in 2024. This marked a 20.7% rise compared to 2023, providing a significant boost in choice for prospective buyers. Wellington led the listings surge with a 37.3% increase, followed by Wairarapa (26.5%) and Hawke’s Bay (25.8%). Southland's 9.4% growth, though more modest, highlights steady confidence among vendors in the region.

Stable Market, Local Opportunities

While prices fell in 11 of New Zealand's 19 regions, the declines were modest, with Nelson & Bays (-3.7%) and Bay of Plenty (-2.4%) recording the largest drops. The overall stability in prices, coupled with increased listings, signals a healthier market dynamic for buyers and sellers.

For Invercargill residents, the market offers promising opportunities. The steady price growth in Southland could attract more attention to the region, known for its affordability and lifestyle benefits. As the Southland property market continues to thrive, local buyers and investors are positioned to benefit from these encouraging trends.