- Southland experiences a 20.2% increase in housing stock and a 36.9% rise in new listings.

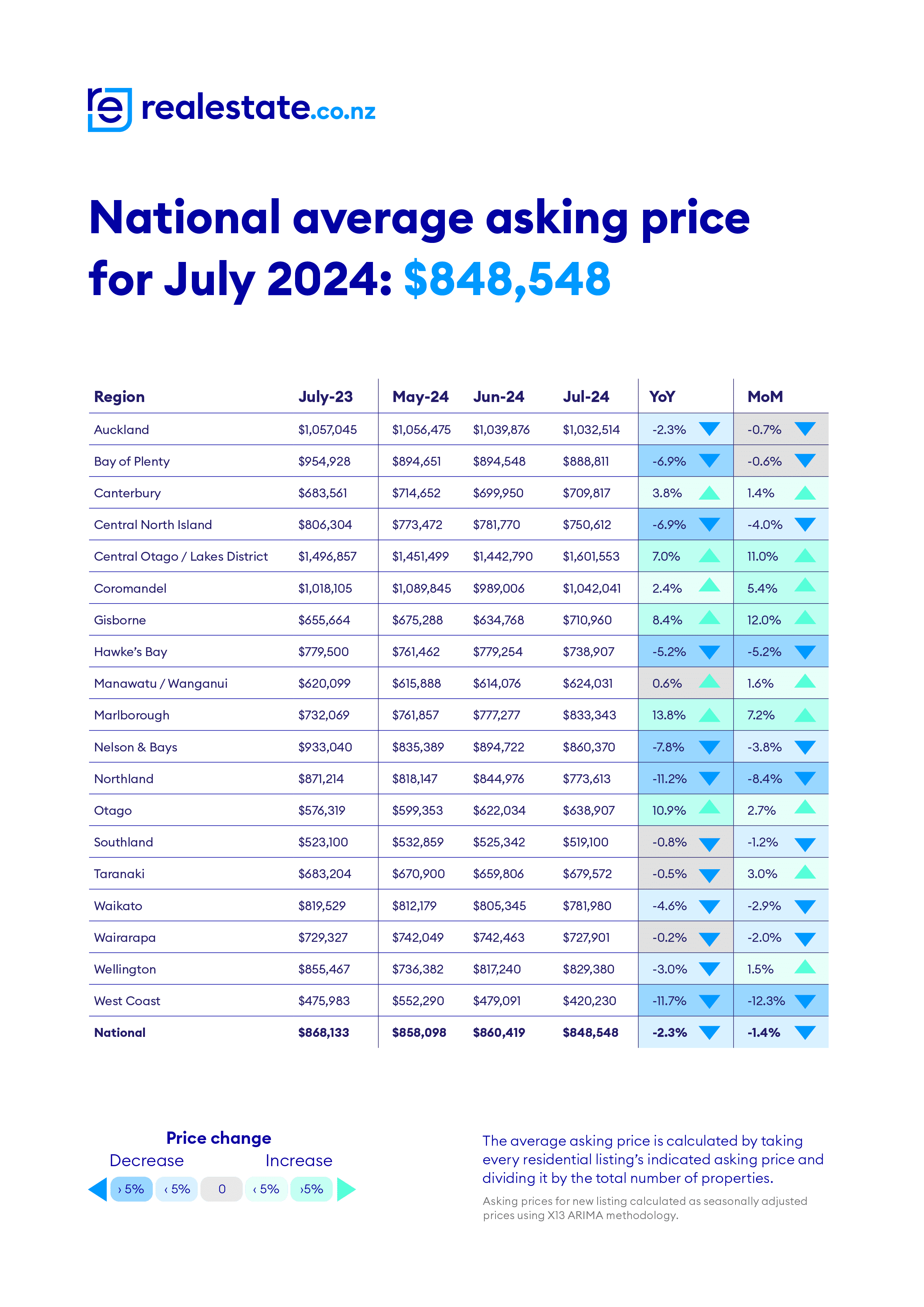

- Average asking prices in Southland dropped by 0.8% to $519,100, indicating a competitive market.

- The property market shows steady activity, with a balanced rate of sale and new investment opportunities.

The property market in Southland is witnessing significant changes, with recent data showing a notable increase in both listings and available housing stock. According to the latest report from realestate.co.nz, the region, particularly Invercargill, is seeing a dynamic shift in market trends.

Related: Banks Cut Mortgage Rates Ahead of Reserve Bank Review

Southland has experienced a record increase in housing stock, with 537 residential properties currently for sale—a 20.2% rise from July 2023.

This increase provides more options for buyers and reflects a national trend, with overall stock growing by 32.3% year-on-year. The abundance of properties could be influenced by recent policy changes encouraging homeowners to list their homes.

The average asking price in Southland has decreased slightly, dropping by 0.8% to $519,100. This local trend aligns with a national decline, where average asking prices fell by 2.3%, reaching $848,548. This price drop may ease the pressure on buyers but suggests a potentially competitive market for sellers, who might need to adjust their expectations.

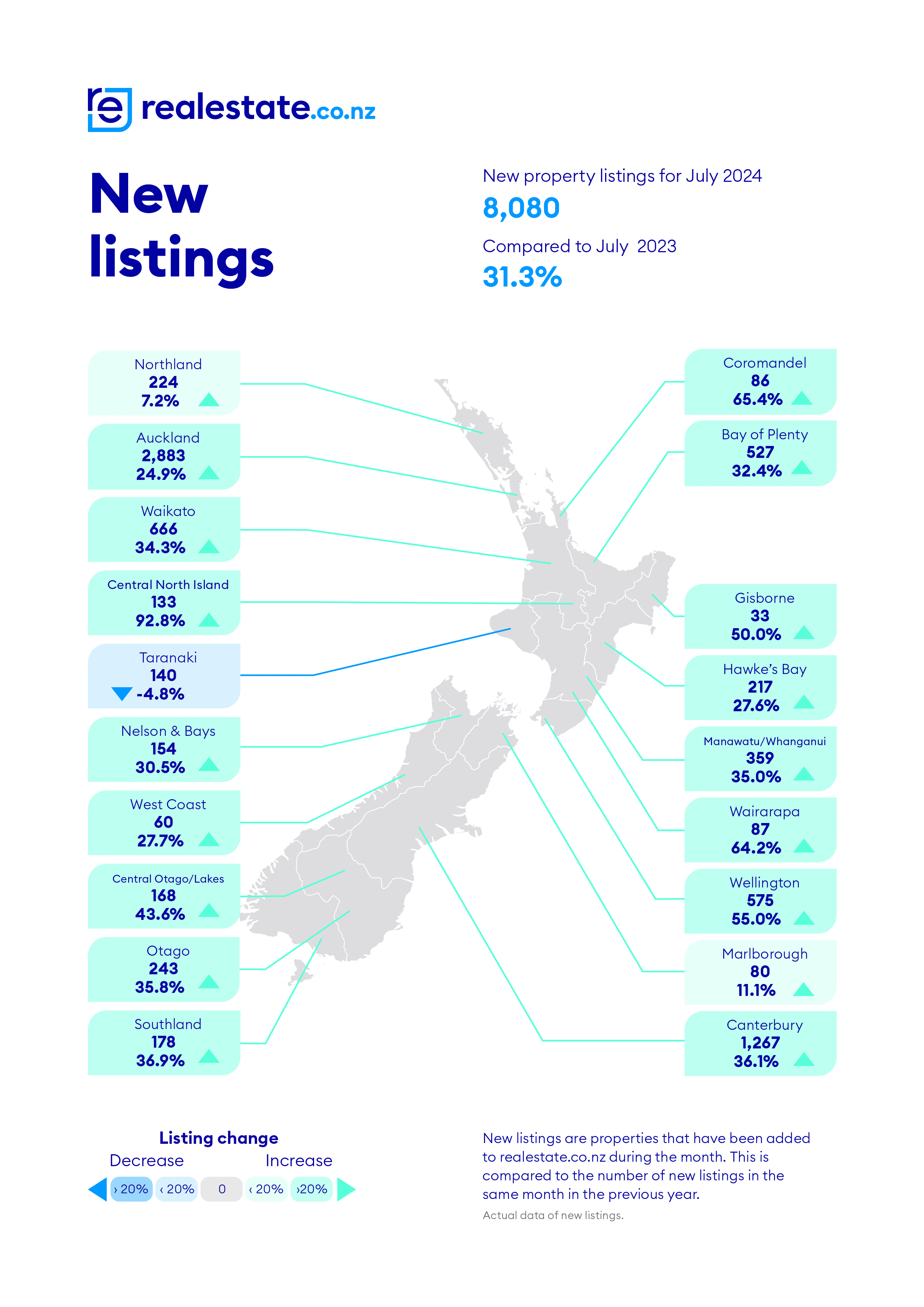

New property listings in Southland have surged by 36.9% compared to last year, with 178 new properties entering the market.

This increase, part of a broader national trend, marks a significant break from a seven-year pattern of lower July listings. Factors such as economic changes and adjustments to the bright-line test, which encourages quicker property sales, may contribute to this surge.

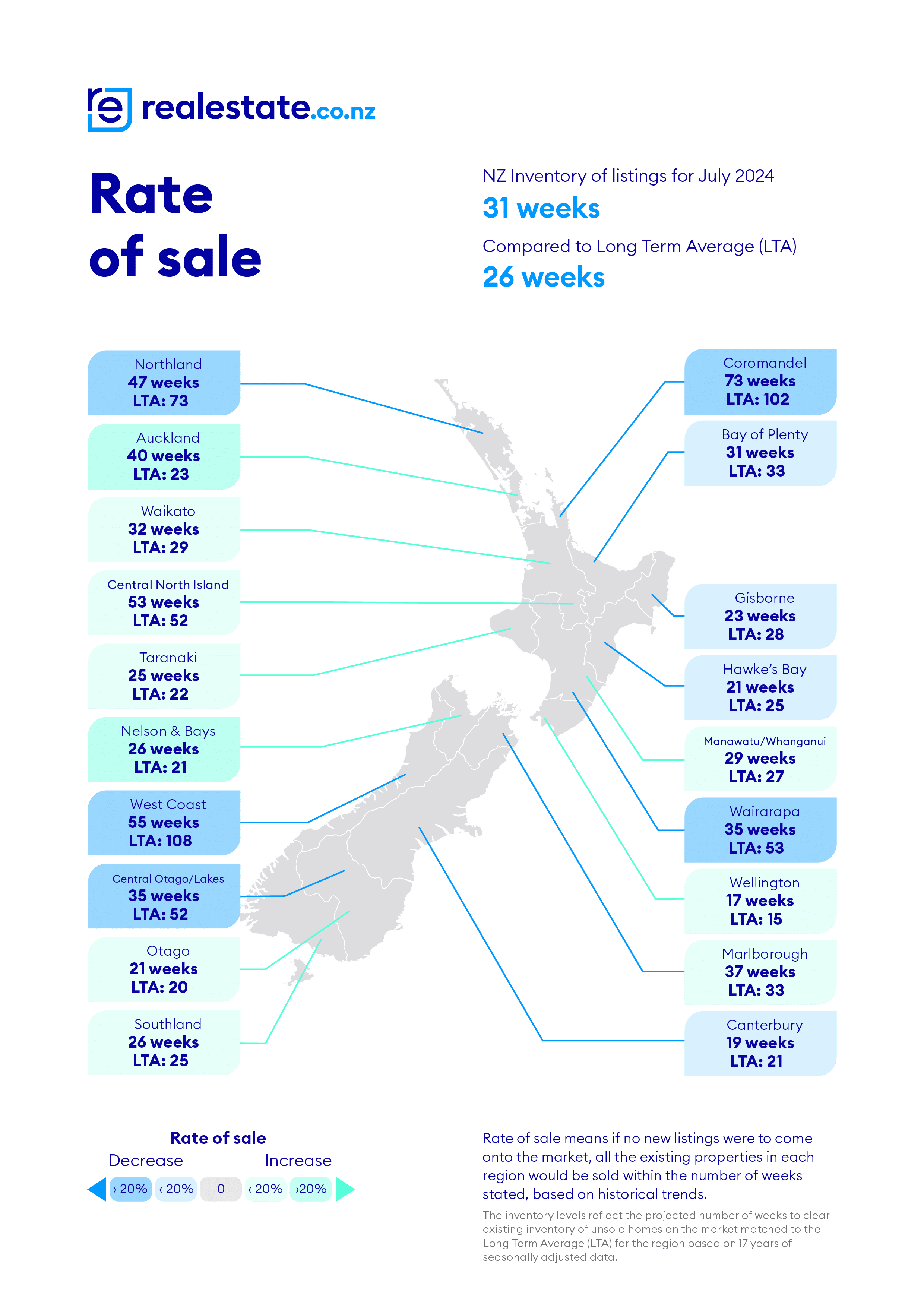

The rate of sale, which measures how quickly current listings are selling, is steady at 26 weeks in Southland. This indicates a balanced market where properties are not moving too quickly or too slowly. Despite the increased inventory, sellers may face more competition, necessitating flexibility during negotiations.

As winter sets in, the market exhibits its typical seasonal slowdown, yet activity remains stable. Jacqui van Dam from Bayleys Southland Real Estate notes a positive trend with the return of first homebuyers, indicating renewed interest. Additionally, multiple offer situations are still occurring, especially in the business property sector, which is seeing a rise in listings, particularly above the $400,000 mark. This trend highlights increased opportunities for investors, with properties often aimed at this demographic, investors are cashing in on their investments along with investors purchasing.