Rio Tinto’s wholly-owned subsidiary Pacific Aluminium (New Zealand) Limited has reported financial results relating to its interest in New Zealand’s Aluminium Smelter Limited (NZAS), showing an underlying net loss of NZ$46 million for 2019.

This is a NZ$68 million decrease in earnings from the previous year’s underlying net profit of NZ$22 million.

The loss is a result of consistently lower and volatile aluminium prices, coupled with uncompetitive energy prices. In 2019, aluminium prices were 15% lower than the previous year, averaging US$1,791 a tonne. While the New Zealand dollar was also lower, this was not enough to offset lower metal prices.

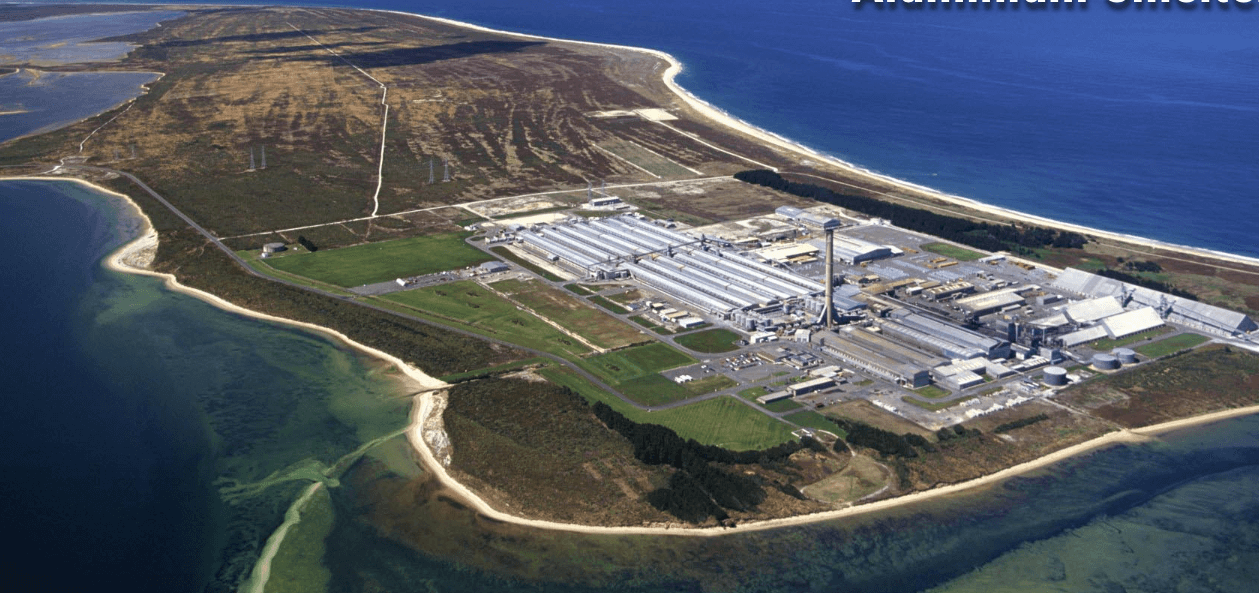

NZAS chief executive and general manager Stew Hamilton said “This result underscores why Rio Tinto is conducting a strategic review of our operation here at Tiwai.”

“No matter how hard or efficiently the team here works, we can’t consistently off-set the high price of power and transmission charges we face. This means we swing from delivering small profits to losses for our owners, making our financial viability uncertain.”

Powered by renewable hydro-electricity, NZAS is well placed to provide low carbon aluminium to meet growing demand for the lightweight metal in the automotive and other industries.

Mr Hamilton said “If we can secure an internationally competitive power arrangement that enables us to be consistently profitable and a transmission charge that more accurately reflects the service we receive, NZAS will be well placed to continue to be a vibrant part of the New Zealand economy, providing primary metal to local kiwi businesses and remaining a major export to Japan.”

“Our transmission costs are the highest of any smelter we are aware of in the world. Most

smelters, especially those located close to generation like NZAS, pay considerably less.

“We want to be part of this country’s low-carbon future and, by producing some of the lowestcarbon aluminium in the world, we believe we have vital role to play in that future.”

The strategic review announced by Rio Tinto in October last year is considering all options, including curtailment and closure, with an update expected in the first quarter in 2020.