The Invercargill property market is in great shape, and the increase in Government valuations released by the Invercargill City Council on October 17th just highlights this further, industry experts say. Check yours here

Property owners are starting to receive their three-yearly rating valuations in the post or via email by independent valuers Quotable Value (QV) on behalf of the ICC. Related: Propertyscouts Invercargill Team Wins Big At Annual Awards

They reflect the likely price a property would have sold for on 1 July 2023, not including chattels.

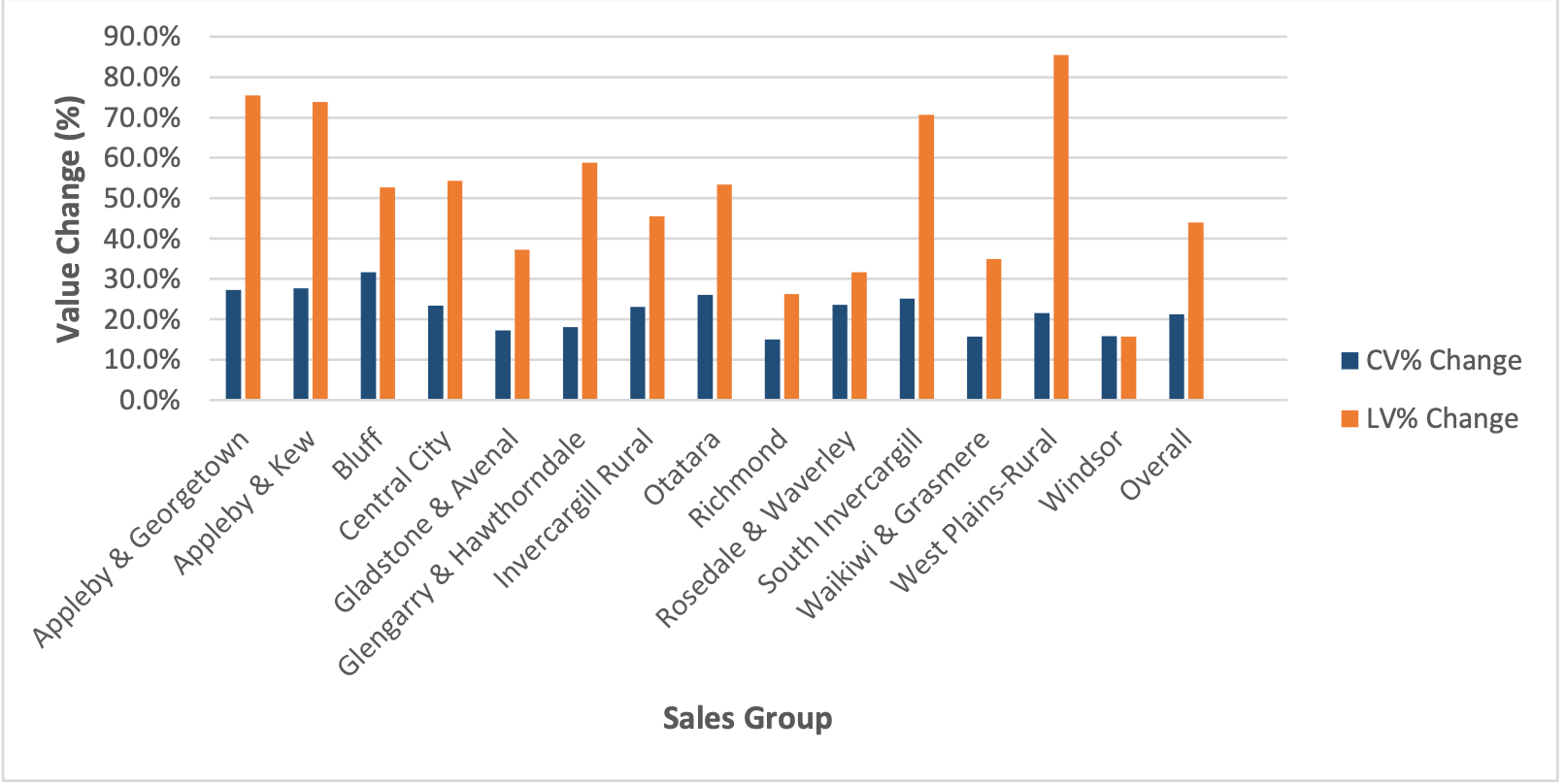

Since the district’s last revaluation in 2020, the value of residential property, which makes up the majority of property in the city, has increased by an average of 21%. The average house value is now $475,000, while the corresponding average land value has increased by 44% to a new average of $194,000.

QV Urban revaluation manager Melanie Halliday commented: “Strong home value increases continued from our 2020 revaluation through to 2022, when the property market cooled significantly. Prices then reduced by around 9.9% from their peak to the effective revaluation date of 1 July 2023.

She said 2023 has been a turning point for residential property in Invercargill, with the market flattening since early in the year.

“Now, in more recent times, we have seen green shoots in the market with QV’s House Price Index data increasing month on month since June. This has largely been driven by a low inventory of houses available on the market, increased demand from first-home buyers, and out of town buyers looking to relocate because of the relative affordability and easy lifestyle the city offers.”

Mortgage Supply company adviser Mandy Jordan and Mike Pero Southland franchise owner Sheree Williams both confirmed the market was very strong at the moment in the South.

“Certainly the market has picked up for us in terms of inquiry and approvals, including outside of Southland investors wanting to purchase in our backyard,” Mandy said.

“It will be interesting what the rates come in at due to three out of four of the past three years on a direct skyrocket in the market, and only coming down slightly in the past six months,” Sheree said.

“With that being said, the market is again heating up coming into the warmer months. More houses on the market. More buyers at open homes. More offers being made.”

The average capital value of an improved lifestyle property has increased by 28% to $753,000, while the corresponding land value for a lifestyle property increased by 28% to $315,000.

“Invercargill’s lifestyle market has seen strong growth since 2020, with its relatively low price point by national standards appealing to those wishing to begin lifestyle living or looking to retire in the area,” Melanie said.

Mandy said banks can use Government Valuations to determine lending amounts, “combine this with LVR ratios improving in the last 6 months and CCCFA loosening, I believe this creates an easier time for people to borrow funds if they want to. Invercargill seems to be in great shape and the increase in government valuations highlights this further.”