The government has scrapped its long-standing target to build 100,000 homes over 10 years and will release properties it is struggling to sell on the open market.

Housing Minister Megan Woods has unveiled the hotly-anticipated reset of the government’s failed flagship policy.

The reset includes setting aside $400 million to help low-and middle-income New Zealanders buy homes through schemes such as shared equity and rent-to-buy, and reducing the deposit needed for a Government-backed mortgage to 5 percent.

The announcement comes seven months after former Housing Minister Phil Twyford said the programme would be reset.

Ms Woods acknowledged the 100,000 target was “overly ambitious” – to date, only 258 homes have been built.

“[It] led to contracts being signed in places where there was little first home buyer demand.

“Instead of the target, we will focus on building as many homes as we can, as fast as we can in the right places.

“Each month we will release a dashboard of housing statistics so New Zealanders can easily measure our progress”, Ms Woods said.

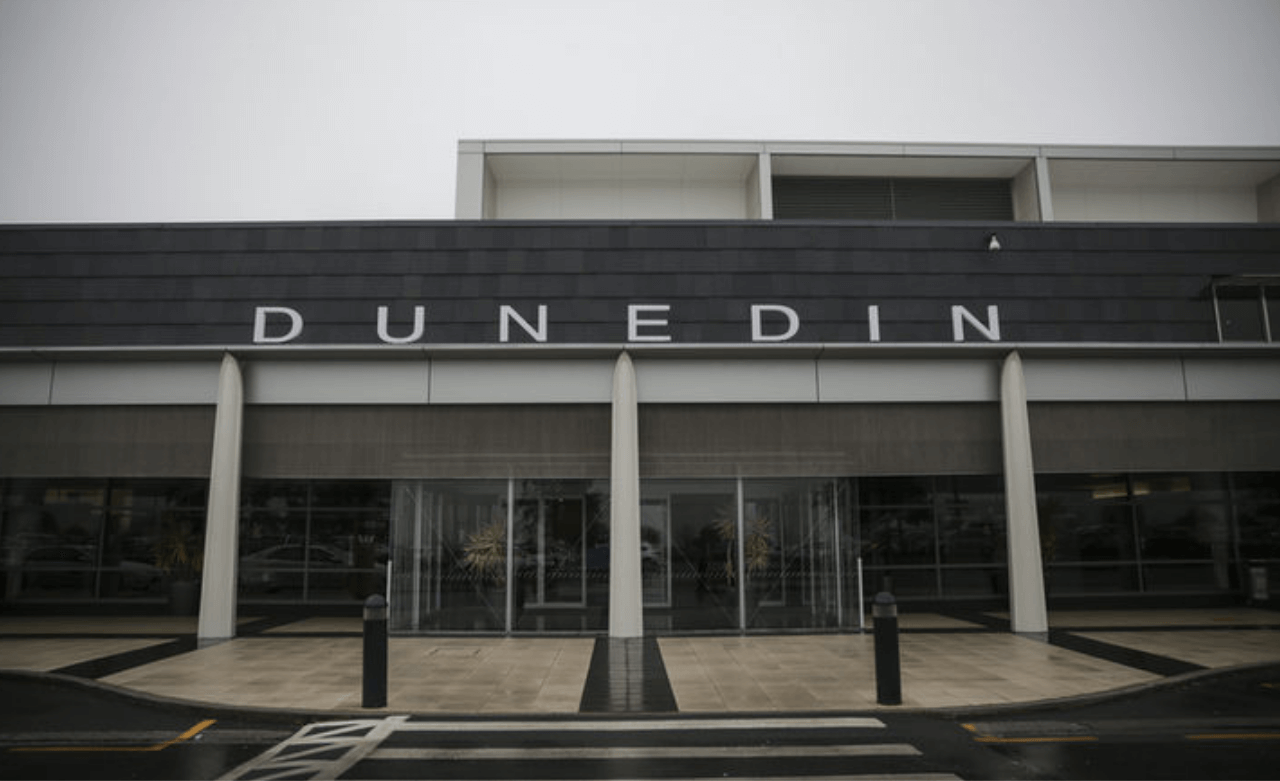

Examples of KiwiBuild houses built in the wrong places include developments in Te Kauwhata, Canterbury, and Wanaka.

Homes in areas that haven’t sold will now be released to the open market.

“Allowing us to reuse the government capital to get more developments underway where there is clear demand,” Ms Woods said.

“We will also be making changes to that government underwrite, reducing the amount available for future developments so developers are incentivised to sell to KiwiBuild first home buyers instead of triggering the underwrite.”

The inclusion of a progressive home ownership scheme in KiwiBuild is part of the government’s confidence and supply agreement with the Green Party.

Greens co-leader Marama Davidson said $400m for schemes like shared equity and rent-to-buy would deliver “meaningful change”.

“Saving a deposit for a home is no longer achievable for many New Zealanders. The way we have approached housing in this country has increasingly locked people out.

“As a government we will now be rolling out progressive home ownership schemes, and supporting community housing providers and iwi to deliver progressive home ownership.”

The reset also includes reducing the downershipeposit required for a government-backed mortgage to 5 percent, and changing the policy settings so that people eligible for the $10,000 First Home Grant will be able to group their funds together.

Source: rnz.co.nz Republished by arranagement.